tax payment forgiveness program

First the total tax debt balance must be equal to or less than 50000. You filed a joint return which has an understatement of tax due because.

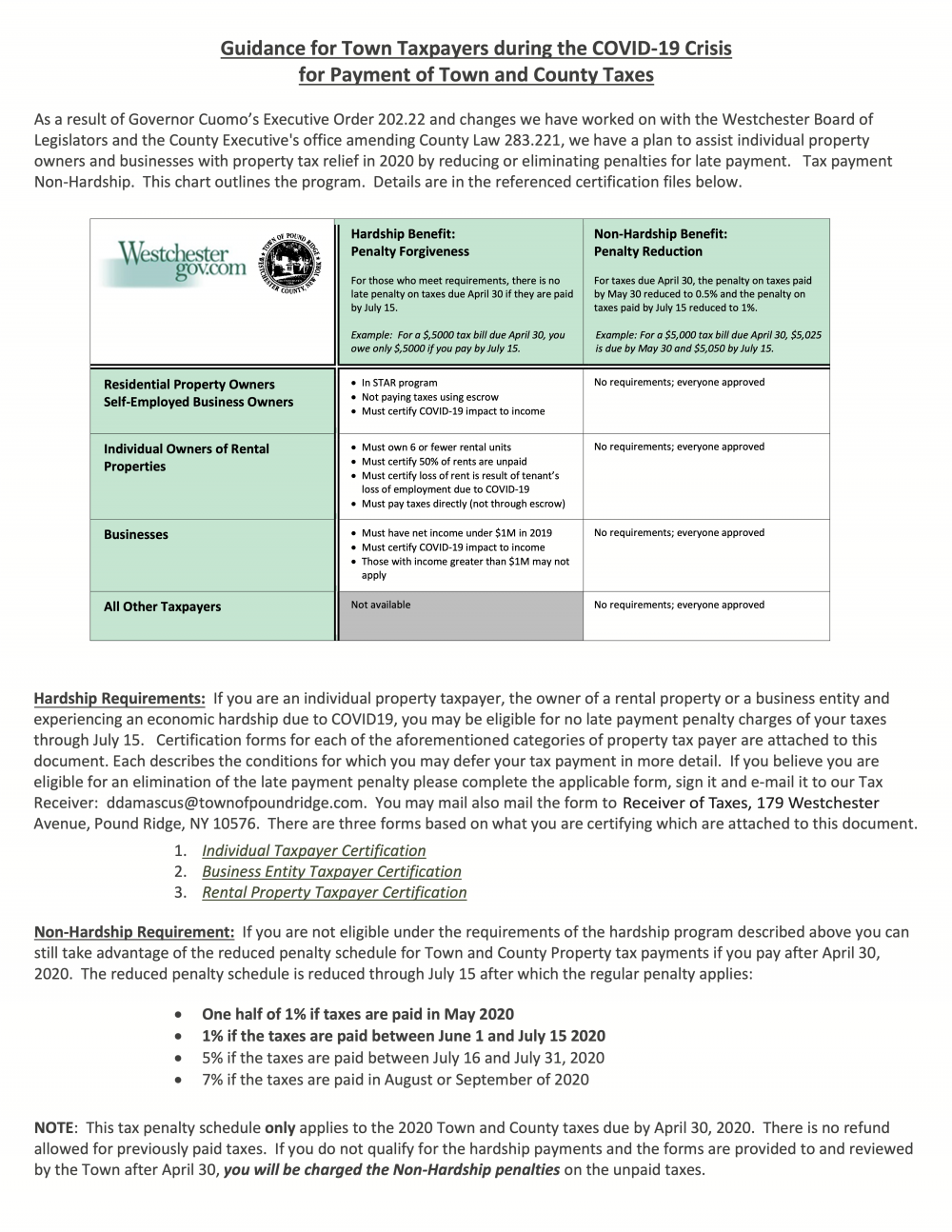

Covid 19 Tax Relief Town Of Pound Ridge New York Official Website

The IRS can continue to collect from your paycheck until youve paid back your tax bill or made other arrangements to pay your debt.

. Approximately 14 million Michiganders. Agree to a direct payment installment forgiveness. For example in Pennsylvania a.

What Is Tax Forgiveness. AGI in either the 2020 or 2021 tax year. Provides a reduction in tax liability and.

State Tax Forgiveness. To qualify for this forgiveness program you must have federal student loans and meet specific income requirements. The average burden per US.

These standards vary from state to state. That borrower whose debt after forgiveness is still twice as much as she earns is a good candidate for income-driven repayment. States also offer tax forgiveness based on personal income standards.

In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least 10000 in back taxes. To help struggling taxpayers affected by the COVID-19 pandemic the IRS issued Notice 2022-36 PDF which provides penalty relief to most people and businesses who file certain 2019 or. Michiganders do not have to pay state or federal taxes on federal loan forgiveness.

The IRS Fresh Start Program allows for tax forgiveness. No the average taxpayer will not have to pay 2100 to cover the cost of student loan forgiveness. So instead of rushing to pay down student loan.

Only 21 of eligible borrowers had been approved. The IRS generally looks at three factors to see if someone qualifies for debt forgiveness. The Biden administration scaled back eligibility for its student loan forgiveness plan Thursday the same day six Republican-led states sued President Joe Biden in an effort to.

Taxpayer will be 250322 according to new estimates from the National Taxpayers Union based on the specifics of Bidens plan. The 2100 cost estimate was based on a hypothetical. The Mayors Office and Department of Finance is offering a late fee forgiveness or amnesty program for residents to take advantage of from October 1 until December 31 2022.

To qualify for partial or total tax forgiveness through this program you must meet all of the following conditions. Then you have to prove to the IRS that you dont have the. Earn less than 100001 200001 for joint taxpayers Owe less than 50000 at the time of application.

Anyone can be eligible to find tax relief with an IRS debt forgiveness program no matter how long or how much you owe for your tax bill. For federal taxes no. Thanks to rules set in the American Rescue Plan Act any student loan debt forgiven through the Biden-Harris plan will not be treated as taxable income.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

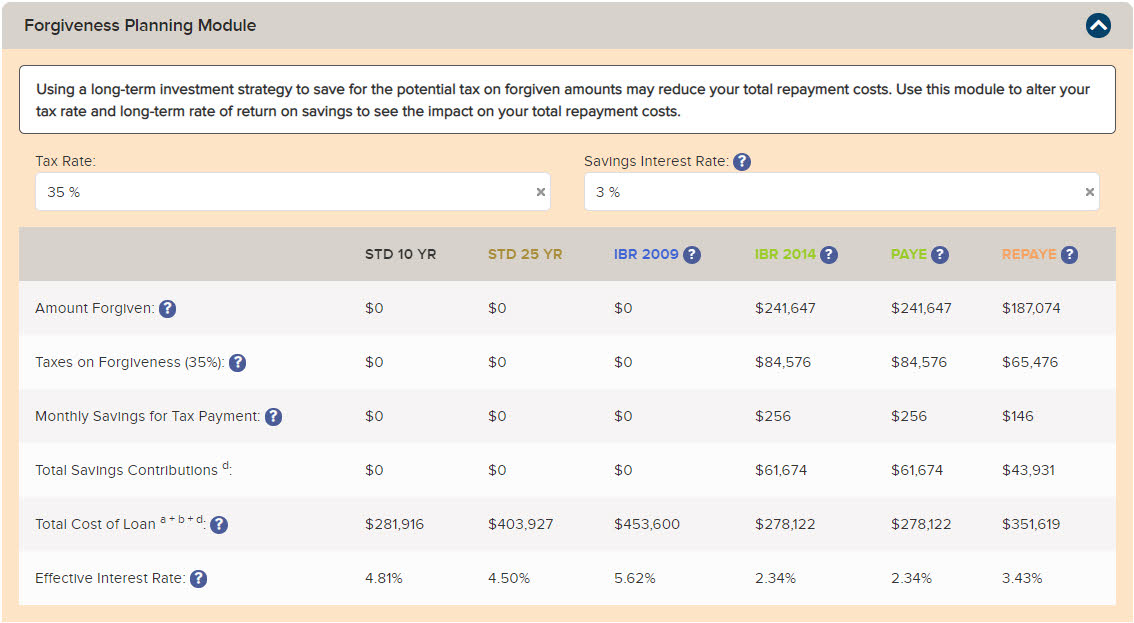

Forgiveness Planning Student Debt Center Vin

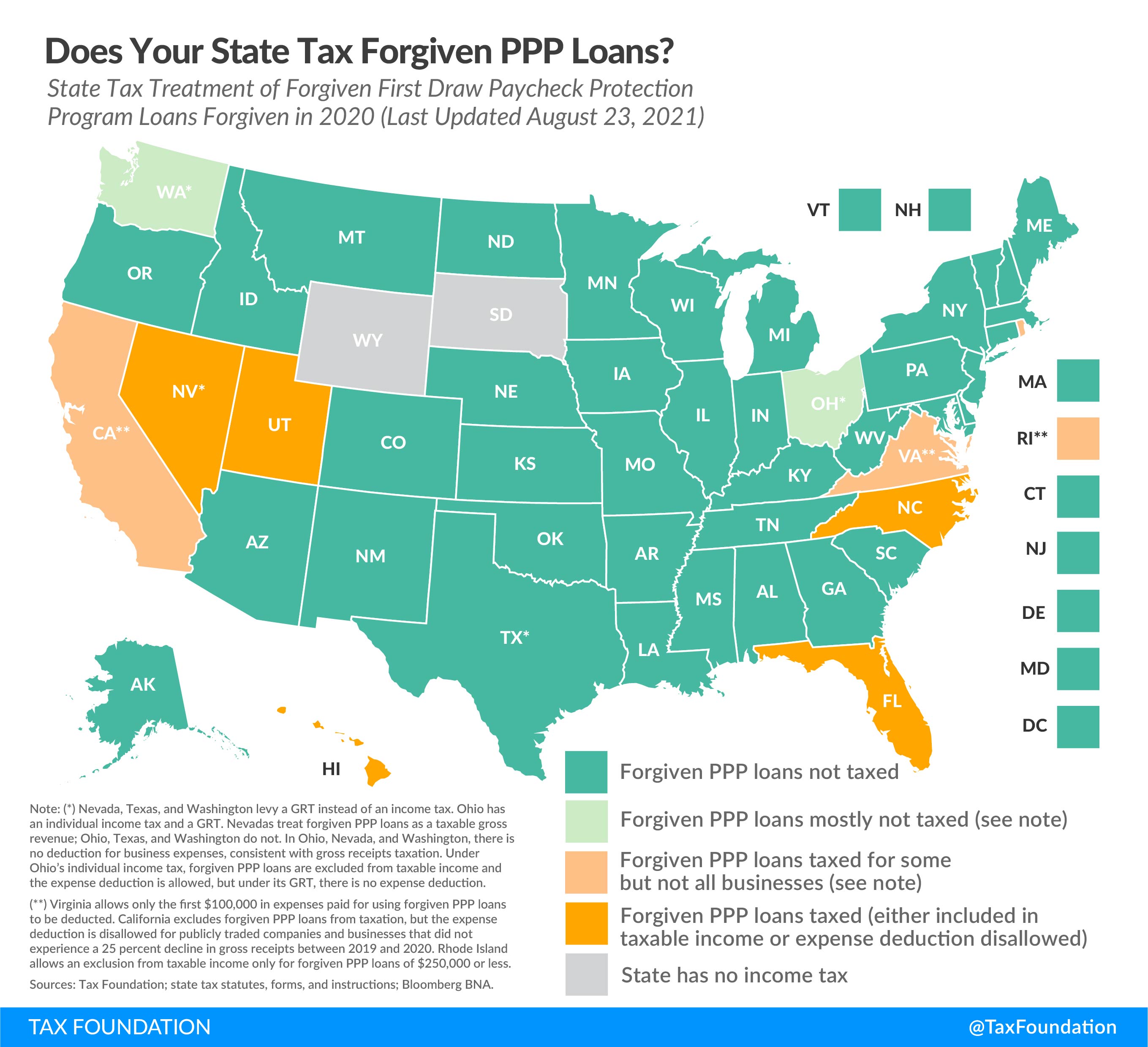

Ppp Loan Forgiveness Which States Are Taxing Forgiven Ppp Loans

What Is The Irs Liability Forgiveness Program The W Tax Group

New Stimulus Package Makes Student Loan Forgiveness Tax Free Student Loan Hero

New Jersey Won T Tax Student Loan Debt Forgiven By Biden Plan New Jersey Monitor

Pay For Taxes Via Direct Pay Credit Card Or Payment Plan

Some States Could Tax Biden S Student Loan Debt Relief Abc News

Irs One Time Forgiveness Program Everything You Need To Know

Irs Debt Forgiveness And Irs Tax Forgiveness Services

Get A Fresh Start The Irs Tax Debt Forgiveness Program

Irs Debt Forgiveness Explained Understanding Tax Debt Forgiveness Program With Free Guides Youtube

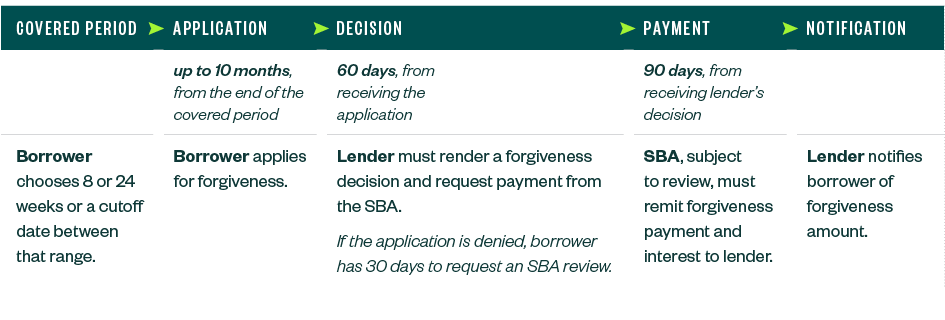

Tax Planning And Reporting Questions With Ppp Forgiveness

Biden Plan Would Eliminate Student Loan Forgiveness Tax Bomb

Cra Tax Debt Forgiveness Tax Forgiveness Programs Kalfa Law

Back Tax Blog Keith Jones Cpa Trusted Tax Relief Company

What Is The Irs Debt Forgiveness Program Tax Defense Network

Federal Student Loan Forgiveness Indiana Will Tax Canceled Debt